With the COVID-19 outbreak meaning all of us are spending more time at home, Bitmedia examine how this is impacting bitcoin’s popularity

Last week was marked by a massive collapse of bitcoin price, triggered by the fall on traditional markets due to the panic over coronavirus. The chaos has spread far beyond the financial world and, as most of the global population stays at home, panic buying has surged - as well as toilet paper and food, there is also an increasing interest in online products.

As people spend most of their time at home, working or studying remotely, they’re automatically spending more time sitting at their computers. Naturally, online entertainment services are getting more attention, together with online communication tools and software for remote working and e-learning.

Here at Bitmedia, a crypto advertising platform, we have felt the impact of the ongoing situation and have taken a closer look at the crypto audience during the lockdown; in particular at the inner statistics, Google Trends and other open source data to assess current trends.

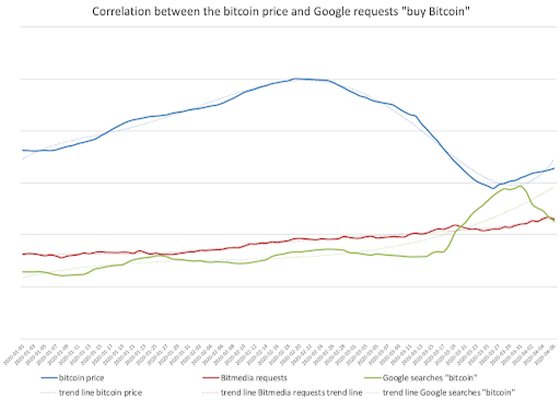

One of our key findings is an increased interest in the purchase of cryptocurrency, as the price has gone down. Based on information from Google Trends, the number of search requests for ‘buy bitcoin’ tripled as soon as the price dropped (see chart).

While there have since been less ‘buy bitcoin’ and ‘bitcoin’ requests on Google, they have grown by more or less 30% compared to the number of requests before quarantine, and the overall trend is on the up.

In accordance with the information on digital currency exchange Coinbase, the percentage of customers who are currently buying bitcoin increased to about 75% over the last week, whereas only 25% of coinbase users were selling bitcoin. This week, despite the price growth, the tendency remains the same and all of the top exchanges like Coinbase, Lmax, P2PB2B show that buy activities of their users prevail.

“During the increase in volatility in all major financial markets, large players tend to reduce their share of high-risk investments, such as cryptocurrencies. This was the underlying reason for the latest collapse in the bitcoin price. Retail buyers, on the contrary, are expecting the inflation coming soon, and hence they are looking for ways to diversify their risks related to traditional banks and fiat money”, says Matvey Diadkov, the CEO of Bitmedia.

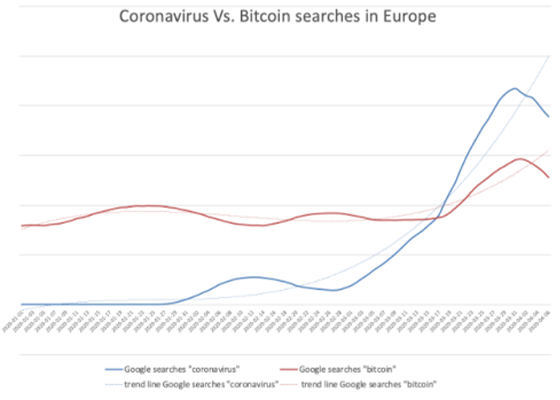

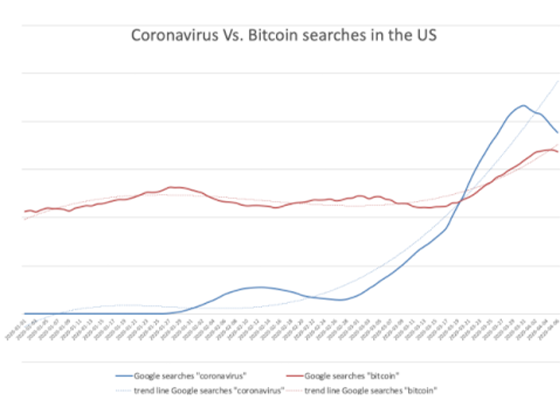

When analysing the trends in the countries that have been influenced by COVID-19 the most, it becomes obvious that people are bulk-buying not just food and basic-need products, they are also actively looking at investing in bitcoin. The chart below shows how the trends and search requests of coronavirus (the blue line) and bitcoin (the red line) correlate between each other.

It is interesting to notice that in Austria, Australia, Switzerland and Netherlands, bitcoin was trending almost as much as the coronavirus at certain points. In Germany the number of Google searches were even higher between March 12 and March 16.

While the number of searches has since decreased, compared to the peak when the price dropped, it is higher than prior to the lockdown and the bitcoin price drop. The same trend can be also observed in the US, where the number of searches for bitcoin has increased, as more and more people have started working from home.

Apart from considering bitcoin as a potential investment, these trends imply that people, while spending more time at home, are trying to find out new information for themselves and it could be likely that the crypto community will have more newcomers soon. At the same time, we can see that when the level of panic has dropped, there is still more interest in the crypto market than prior to the social distancing measures.

As well as the price trends, there are some other crypto-market happenings connected with the coronavirus situation. In accordance with the inner statistics provided by the Bitmedia team, the number of visitors of crypto-related websites has increased by 40%. When it comes to geos, Europeans are getting more and more active on crypto websites.

All in all, despite the recent price drop, the crypto market is showing good signs of holding up well at the moment. The bitcoin market has room to keep growing and I believe that it will prove itself during a time of instability for traditional markets. So stay safe, wash your hands and HODL.

Posted on: Friday 17 April 2020